Best Crypto Tax Software in 2024

Table of Contents

In the fast-paced world of cryptocurrencies, navigating the labyrinth of tax obligations can feel like traversing uncharted territory. With the rise of digital assets, the need for efficient tax solutions has never been more pressing. As the saying goes,

and in the realm of crypto investments, that responsibility includes ensuring compliance with tax regulations.

Fortunately, the emergence of crypto tax software has revolutionized the way individuals manage their tax obligations. These innovative tools offer a lifeline to investors and traders, streamlining the complex process of tax reporting and saving valuable time and effort in the process.

Join us as we explore the leading solutions in the market — CoinLedger, Coinpanda, CoinTracking, Koinly, and ZenLedger. From intuitive interfaces to robust reporting features, we’ll uncover the unique strengths of each platform, empowering you to navigate tax season with confidence and ease. With the right tools at your disposal, fulfilling your tax obligations in the world of cryptocurrencies can be not only achievable but also empowering.

How does crypto tax software work? #

Crypto tax platforms typically integrate with popular cryptocurrency exchanges and wallets, allowing for seamless importation of transaction data. By leveraging this data, crypto tax software generates comprehensive tax reports, providing insights into capital gains or losses incurred throughout the tax year.

One of the key functionalities of crypto tax software is its ability to accurately determine which transactions are taxable and which are not, alleviating users from the burden of manual calculations and tax determinations. Additionally, these tools often offer tax optimization features, such as capital loss deductions and tax loss harvesting, to help users minimize their tax liabilities.

The accuracy and reliability of crypto tax software depend on several factors, including how it imports and analyzes transactions. API integrations with exchanges, wallets, and decentralized finance (DeFi) platforms are preferred, as they minimize the risk of human error and ensure the extraction of all relevant transaction data. Conversely, manual CSV file uploads may introduce errors and omissions, potentially leading to inaccuracies in tax reporting.

Moreover, the reliability of crypto tax software hinges on its access to up-to-date tax rules and regulations for each supported country. Platforms that stay abreast of tax rule changes can provide more accurate tax calculations and recommendations, enhancing the overall user experience.

Below are profiles of some of the leading crypto tax products, listed in alphabetical order:

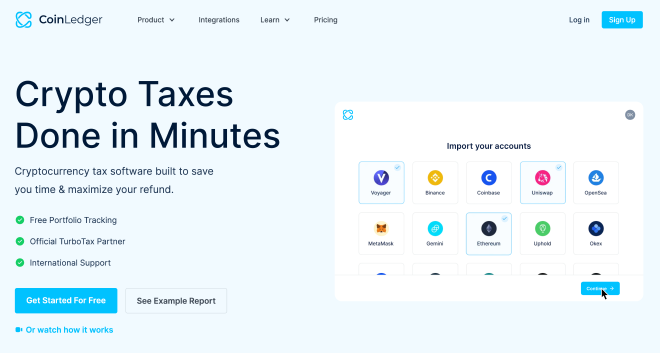

CoinLedger #

CoinLedger has established itself as a leading crypto tax and portfolio tracking platform trusted by over 400,000 investors worldwide. With its seamless integration with TurboTax and support for more than 100 platform integrations, CoinLedger simplifies the complex process of reporting crypto taxes, making it accessible to users of all levels of expertise.

Designed to be user-friendly and efficient, CoinLedger allows traders to import wallets and transactions within minutes, enabling them to generate tax reports swiftly and accurately. The platform supports over 200 exchanges, wallets, and other crypto services, ensuring comprehensive coverage for users.

A key highlight of CoinLedger is its audit trail feature, which provides a detailed documentation of every taxable event, enhancing transparency and precision in tax filings. Additionally, CoinLedger offers integrations with major tax preparation platforms like TurboTax, facilitating seamless tax reporting for users across different countries and currencies.

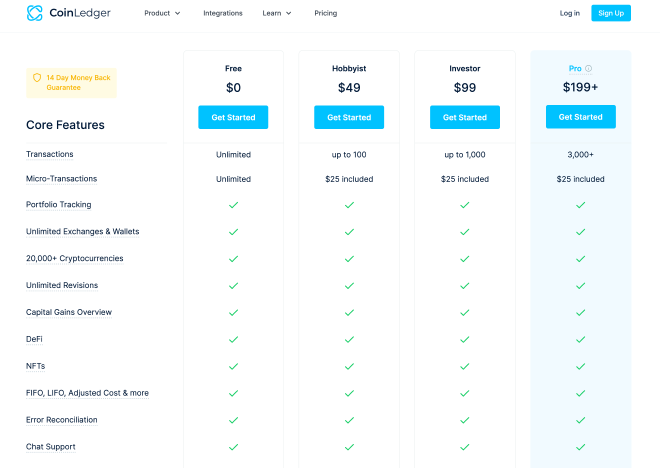

CoinLedger’s pricing structure is tailored to the volume of transactions, with plans ranging from $49 for up to 100 trades to $499 for users with unlimited number of trades. Each paid plan includes support for various tax forms, DeFi income, and live chat/email support, catering to the diverse needs of crypto traders.

Overall, CoinLedger stands out for its simplicity, reliability, and comprehensive features, making it an invaluable tool for managing crypto taxes and portfolios with ease.

Pros & Cons #

Pros #

- Comprehensive Support for DeFi, NFTs, and Various Exchanges and Blockchains

- Tax-Loss Harvesting Feature, Facilitating Tax Savings Opportunities

- User-Friendly Interface with Guides for Easy Transaction Import

- Integration with Tax Software Platforms like TurboTax, TaxAct, and H&R Block

Cons #

- Limited Transaction Coverage in Lower-Tier Plans, such as the $199 option covering only up to 3,000 transactions

- Lack of Support for Cryptocurrency Payments, with CoinLedger not accepting Bitcoin, Ethereum, or other cryptocurrencies as payment

Pricing Tiers #

Coinpanda #

Coinpanda stands out as an exceptional crypto tax software solution, offering a comprehensive suite of features tailored to meet the needs of cryptocurrency traders worldwide. With its user-friendly interface and robust functionality, Coinpanda simplifies the tax reporting process, allowing users to generate accurate tax reports in a matter of minutes.

One of Coinpanda’s standout features is its support for a wide range of crypto products, including leveraged crypto products such as margin accounts, leveraged tokens, and derivatives like options and futures. Calculating taxes on these complex investment products can be challenging, but Coinpanda handles it with ease, taking into account factors like opening and closing prices, financing fees, and commissions.

With integrations with over 500 exchanges, 115 wallets, and compatibility with 242 blockchain standards, Coinpanda offers unparalleled coverage for cryptocurrency transactions. Whether you’re trading traditional cryptocurrencies or engaging in DeFi platforms like Algorand and Uniswap, Coinpanda has you covered.

Furthermore, Coinpanda supports tax reporting for over 65 countries, including major jurisdictions like the US, UK, and most of Europe. This ensures that users worldwide can easily comply with their local tax regulations and obligations.

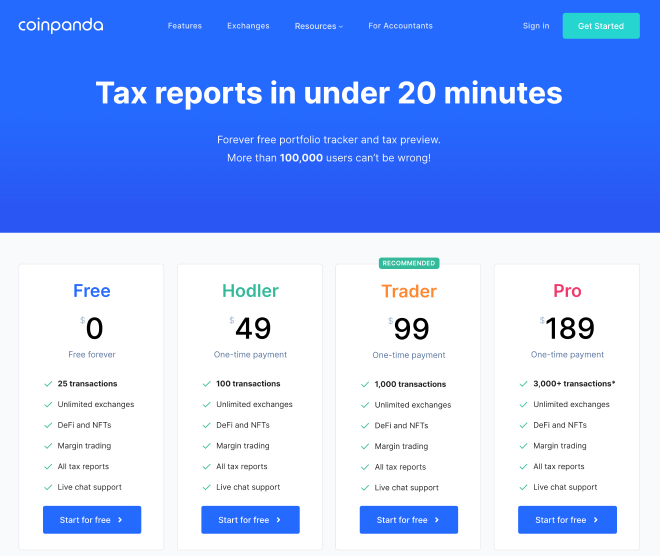

Coinpanda’s pricing is flexible and transparent, with options ranging from a free plan for users with fewer transactions to premium plans priced at $189 for up to 3,000 transactions. Regardless of the plan chosen, users can expect unlimited imports, support for DeFi and NFTs, country-specific reports, and compatibility with popular tax filing software like TurboTax and TaxAct.

In summary, Coinpanda offers an unparalleled combination of functionality, ease of use, and global compatibility, making it the go-to choice for cryptocurrency traders seeking a reliable and efficient tax reporting solution.

Pros & Cons #

Pros #

- Comprehensive Support for Tracking Leveraged Positions, Futures, Margin Trades, and DeFi Transactions

- Wide Integration with Over 500 Exchanges and 115 Wallets, Facilitating Easy Transaction Data Import

- Quick and Easy-to-Use Interface, Praised by Many Customers

- Professional Suite Available for CPAs and Tax Professionals to Generate Reports for Clients

Cons #

- Difficulty in Manual Transaction Reconciliation

- Limitations on Transaction Volume, with the $189 plan covering only up to 3,000 transactions

Pricing Tiers #

CoinTracking #

CoinTracking stands out as a premier solution for cryptocurrency reporting and tracking, serving a vast user base of over 1.5 million clients, including both individual users and corporate entities, as well as CPAs. Its popularity is underscored by its robustness and comprehensiveness, which have made it a trusted tool among tax professionals and retail users alike. Notably, CoinTracking offers not only top-notch tax functionalities but also powerful portfolio tracking tools, making it a comprehensive platform for managing crypto assets.

The web-based interface of CoinTracking facilitates seamless connectivity to exchanges via API or CSV files, allowing users to access their complete trading history and perform real-time profit, loss, and tax calculations. This transparency empowers users to gain insights into their portfolio performance and anticipate their tax liabilities throughout the year. Moreover, CoinTracking supports over 100 countries, making it a versatile choice for users worldwide.

One of CoinTracking’s key strengths lies in its extensive support resources, including detailed tutorials and access to tax advisors, which can be invaluable for users navigating the complexities of crypto tax reporting. Additionally, CoinTracking boasts an impressive network of tax professionals available in 75 countries, ensuring that users have access to expert guidance whenever needed.

However, it’s worth noting that CoinTracking’s pricing structure, starting at approximately $129 per year, may be higher compared to some of its competitors. Despite this, the platform’s reputation for reliability and accuracy, coupled with its extensive features and support resources, make it a top choice for individuals, traders, institutions, and companies alike seeking comprehensive cryptocurrency tracking and tax reporting solutions.

Pros & Cons #

Pros #

- Comprehensive Trade Tracking and Portfolio Analysis

- Extensive Exchange, Wallet, and Blockchain Integrations

- Simplified Tax Reporting

- Time-Saving Automation with Bulk Importing and Automatic Transaction Import via API

- Accessible Customer Support and Educational Resources

Cons #

- Complicated Interface, Especially for New Users

- Dated Design and Aesthetics

- Lack of Automatic Transaction Imports on the Free Plan

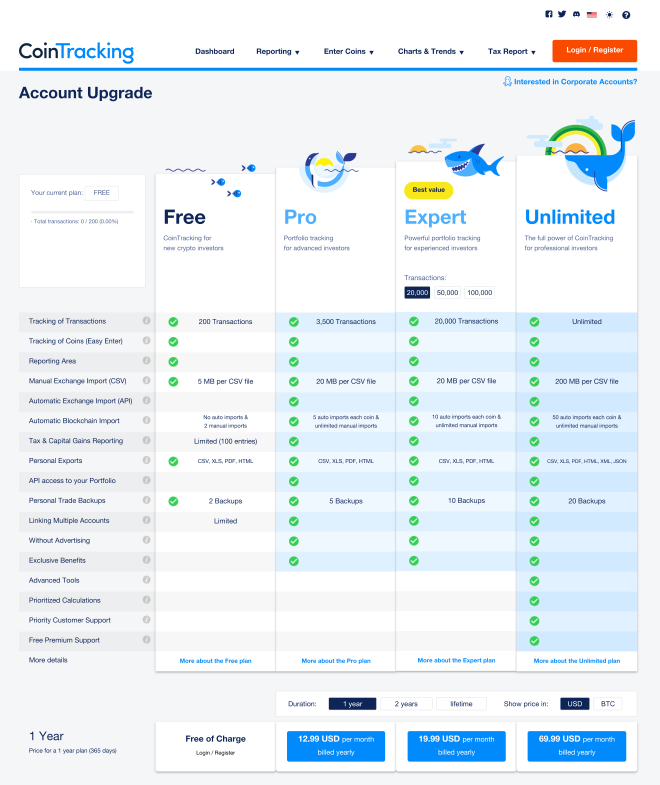

Pricing Tiers #

Koinly #

Koinly stands out as a comprehensive crypto accounting and tax reporting platform, offering a wealth of features tailored to meet the needs of both individual users and businesses. With support for over 20 countries, including major markets like the U.S., Australia, and Canada, Koinly ensures compliance with local tax regulations. Developed in collaboration with tax firms worldwide, Koinly’s reports, such as Form 8949 and Schedule D, are trusted by CPAs globally.

The platform boasts extensive coverage, supporting over 23,000 cryptocurrencies, 170 blockchains, 400 exchanges, 100 wallets, and more than 30 crypto services. Beyond tax reporting, Koinly provides a holistic view of users’ crypto portfolios, allowing them to track performance over time and visualize their holdings with intuitive graphs.

A standout feature of Koinly is its smart-matching AI system, which intelligently identifies and excludes intra-wallet transactions from tax reports, reducing the risk of double taxation. Additionally, Koinly offers error reconciliation tools to help users rectify data discrepancies, ensuring accuracy in tax reporting.

Koinly’s user-friendly interface simplifies the tracking of crypto activities, making it suitable for both beginners and experienced traders. Moreover, the platform offers robust customer support via live chat and email, providing assistance when needed.

While Koinly offers a feature-packed free version, paid plans unlock additional benefits such as priority customer support and advanced reporting options. Pricing is competitive, starting at just $49 per year for up to 100 transactions, making Koinly an accessible option for traders of all levels.

In summary, Koinly is an excellent choice for individuals and businesses seeking to streamline their crypto tax reporting and portfolio management processes, offering comprehensive features, reliable support, and user-friendly interface.

Pros & Cons #

Pros #

- Wide Range of Supported Crypto Assets, Blockchains, Exchanges, and Wallets

- Localization for Over 20 Countries, with Generic Reports Useful for Over 100 Countries

- Intuitive and Simple Interface, Suitable for Beginners

- Advanced Features for Handling DeFi, NFT, Margin Trading, and Staking Transactions

- Tax Harvesting Capabilities, Allowing for Optimization of Tax Liabilities

Cons #

- Not Fully Automated, Some Transactions Require Manual Input

- IRS-Compliant Tax Forms Only Available for Paid Plans

- Transaction Limit of 100,000 Transactions per Year

- Reports of Mislabeled Transactions Reported by Some Customers

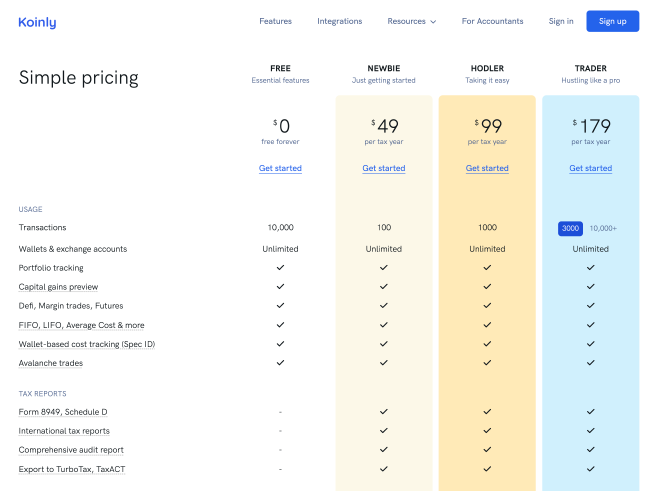

Pricing Tiers #

ZenLedger #

ZenLedger stands out as a comprehensive and user-friendly platform for calculating cryptocurrency taxes and managing digital assets. With support for over 400 exchanges, 50 blockchains, and 100 DeFi and NFT protocols, ZenLedger offers extensive coverage to meet the needs of crypto enthusiasts worldwide. Founded in 2017, ZenLedger has garnered praise from major media outlets like the Wall Street Journal, Bloomberg, and Forbes, highlighting its credibility and reliability in the industry.

One of ZenLedger’s key strengths lies in its seamless integration with TurboTax, making tax reporting a hassle-free experience for US-based hodlers. The platform’s IRS-friendly reports ensure compliance with tax regulations, catering to users of all levels, from casual traders to seasoned investors.

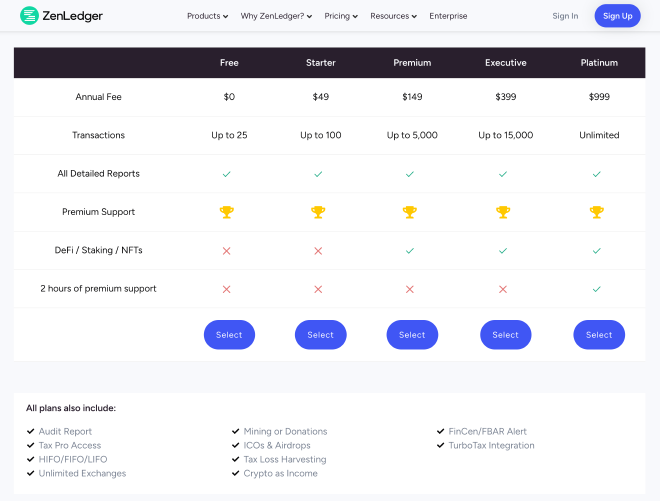

Pricing options are flexible, with plans starting at $49 and varying based on transaction volume and additional features like DeFi and staking support. Notably, all plans include premium support, offering chat and phone assistance to users.

ZenLedger’s focus on the US market is evident in its provision of country-specific pre-filled tax forms and TurboTax integration, simplifying the tax filing process for American users. Additionally, the platform’s tax-loss harvesting tool helps users optimize their tax liabilities.

Pros & Cons #

Pros #

- Seamless Integration with TurboTax, Facilitating Easy Tax Reporting

- Comprehensive Support for DeFi, Staking, and NFTs, Catering to Diverse Crypto Income Streams

- Tax-Loss Harvesting Feature, Providing Strategies to Minimize Tax Liabilities

- Premium Customer Support Available Across All Plans, Including Chat and Phone Assistance

Cons #

- Challenging User Experience, Criticized for Being Difficult and Complicated to Use

- Minimum Purchase Requirement of $149 for Full DeFi Integration

- Lack of Mobile App for Portfolio Monitoring and Inability to Pay with Cryptocurrency

Pricing Tiers #

Closing Insights #

Navigating the world of crypto taxes may not be the most thrilling weekend activity, but with the right tools, it can certainly become a smoother, stress-free process. For those of us living outside the top crypto tax-friendly jurisdictions, handling crypto taxes is simply a part of life.

Fortunately, the solutions we’ve explored in this comparison make the task of calculating and filing taxes a breeze, providing peace of mind to crypto enthusiasts everywhere. These platforms not only streamline the process but also ensure accuracy in tax reporting, helping users avoid potential penalties or fines.

Moreover, in a landscape where crypto tax laws are evolving faster than ever, these platforms remain agile, keeping users compliant with the latest regulations in their respective countries. Whether you’re trading, dealing with NFTs, mining, staking, or engaging in other crypto activities, these tools have got you covered.

Remember to choose a solution that aligns with your specific needs, whether you’re a DeFi enthusiast, a power user, or a CPA seeking extensive integrations. With the right crypto tax software by your side, you can simplify record-keeping, automate tax form filling, and ensure compliance with complex tax regulations.

Frequently Asked Questions #

Do I need to pay taxes on cryptocurrencies?#

The taxation of cryptocurrencies varies significantly depending on your jurisdiction and the nature of your transactions. In most cases, selling crypto assets can trigger capital gains taxes, while active trading may be subject to income taxes. However, exemptions or special regulations may apply in certain situations, such as transferring cryptocurrency between your own wallets.

To ensure compliance with tax laws and regulations, it’s essential to consult with a knowledgeable accountant or tax advisor in your country. They can provide personalized guidance tailored to your specific circumstances, helping you navigate the complexities of crypto taxation effectively. By staying informed and seeking professional advice, you can confidently manage your tax obligations and avoid potential pitfalls in the world of digital assets.

Do crypto exchanges report directly to tax authorities?#

Indeed, transparency and compliance are becoming increasingly integral to the operations of major crypto exchanges like Binance and Coinbase. While the specifics may vary based on jurisdiction, many exchanges are mandated to report certain transactions to tax authorities. This obligation ensures adherence to regulatory frameworks and promotes accountability within the crypto ecosystem.

While the focus may currently be on regions like the US, similar initiatives are emerging across the globe, including in Europe with directives like DAC8. These developments underscore a broader trend towards greater transparency and regulatory alignment within the cryptocurrency space. As such, investors and traders can expect increased clarity and accountability, fostering a more robust and trustworthy crypto environment for all stakeholders.

Can I use crypto tax software for free?#

In the realm of crypto tax software, it’s important to recognize that while some platforms may offer initial access for free, generating official tax reports typically requires payment. These free plans often come with transaction limits or restricted features, necessitating an upgrade to a paid service for comprehensive reporting functionalities. Thus, users should be aware that while certain aspects of these tools may be complimentary, ultimately, ensuring full compliance with tax regulations usually involves investing in a paid subscription or service.

Can I claim crypto losses on taxes?#

Absolutely, in numerous jurisdictions, individuals can indeed claim losses incurred from crypto assets on their taxes. These losses often serve as valuable deductions, capable of offsetting capital gains, much like losses incurred from traditional investments such as stocks.

What is the best crypto tax software?#

Determining the best crypto tax software involves considering various factors such as functionality, user-friendliness, and compatibility with different tax situations. Koinly often stands out as a top choice, catering to both simple and complex crypto tax needs across multiple countries. Meanwhile, CoinLedger emerges as a standout option for DeFi enthusiasts, seamlessly pulling transactions from popular blockchains like Ethereum and Solana while offering advanced features such as tax-loss harvesting and dedicated NFT tax loss harvesting capabilities.

How can I avoid taxes on crypto?#

While it may seem appealing to evade taxes on crypto, the only legitimate way to do so is by relocating to a country with favorable crypto tax policies. However, attempting to conceal crypto taxes is ill-advised, as many exchanges now enforce Know Your Customer (KYC) protocols and maintain agreements with local tax authorities. Transparency and compliance are essential in navigating the complexities of crypto taxation, ensuring peace of mind and legal adherence in your financial endeavors.

How do I import crypto transactions into a crypto tax software?#

Importing crypto transactions into your chosen crypto tax software typically involves seamless automation by connecting your exchange or wallet via API keys or public keys. This streamlined process ensures that the majority of your transactions are imported automatically, minimizing manual input. For any remaining transactions, you have the option to import them manually or via uploading a CSV file. By leveraging these intuitive import methods, you can efficiently compile and organize your crypto transaction data, facilitating accurate tax reporting and compliance.